Introduction

In this blog, we’re taking a closer look at a powerful payment feature that delivers substantial benefits for finance teams. By enhancing working capital management, improving margins, and reducing operational costs, this solution offers tangible value for organizations looking to streamline their accounts payable (AP) process.

The Accounts Payable Conundrum

While it may not be the flashiest part of a finance operation, accounts payable plays a pivotal role in any well-run organization. It determines who holds cash the longest in transactions, directly affecting cash flow, profitability, and administrative efficiency. Here’s why AP optimization matters:

1. Working Capital

Extending Days Payable Outstanding (DPO) allows companies to hold cash longer, enhancing cash flow for investments, operational needs, or capital projects. This added liquidity can lower borrowing costs, improve access to capital, and offer flexibility for strategic opportunities or unexpected expenses.

2. Profit Margins

Suppliers often offer discounts for early payments, improving margins. However, this accelerates cash outflow, creating a balance between cash retention and profitability. Finance teams must carefully evaluate the trade-offs to optimize cash flow.

3. Administrative Overhead

Manual processes, like paper invoices and checks, drive up costs and inefficiencies. Challenges such as payment errors, fraud, and supplier inquiries add to operational burdens, delaying payments and straining relationships.

The good news? AP automation addresses these issues, improving working capital, profit margins, and administrative efficiency.

A Smarter Approach: Virtual Cards

Oracle B2B introduces virtual cards, a simple and effective way to streamline digital payments. Virtual cards offer benefits for both buyers and suppliers, from reducing manual workloads to improving cash flow.

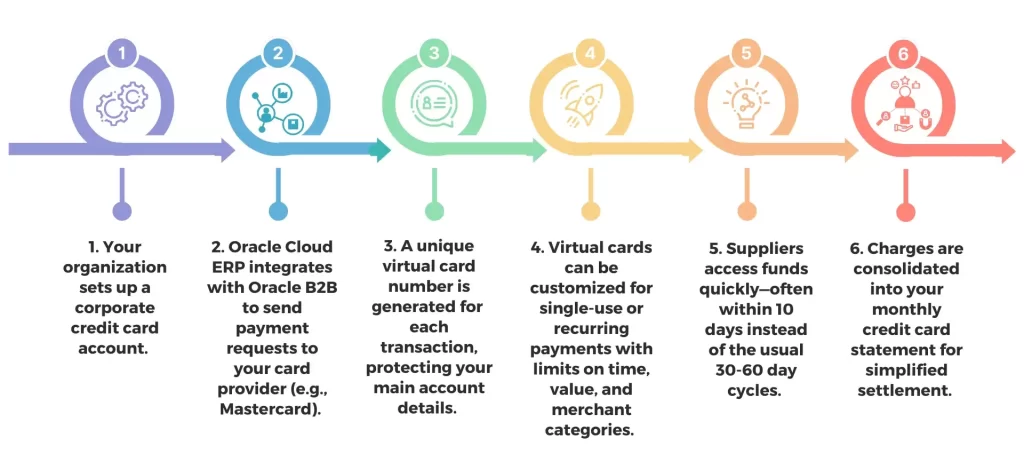

How Virtual Cards Work

Key Benefits of Virtual Cards for Finance Teams

Virtual cards offer several advantages over traditional payment methods like ACH or checks:

- Improved Working Capital: Extend payment cycles without affecting supplier relationships, providing up to 48 days of additional float to free up cash for critical needs.

- Lower Operational Costs: Automation eliminates manual tasks, reducing costs tied to check issuance, reconciliation, and errors.

- Margin Opportunities: Faster payments unlock supplier discounts, boosting profitability.

- Stronger Supplier Relationships: Reliable, predictable payments strengthen partnerships and create opportunities for better terms.

- Enhanced Security: Unique virtual card numbers improve security, reduce fraud, and enhance auditability.

- Potential Rebates: Some banks offer rebates for virtual card usage, generating additional revenue.

Why Suppliers Benefit Too

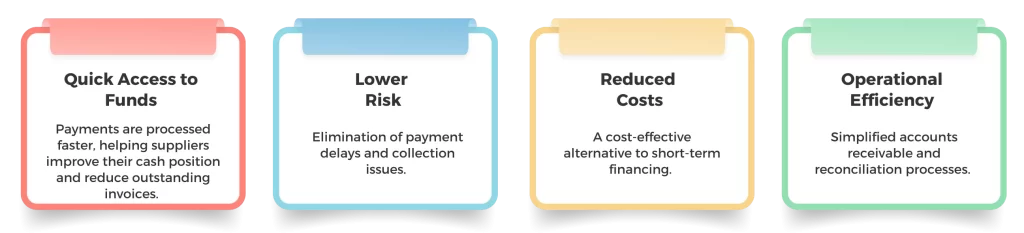

Suppliers benefit directly from virtual cards with:

While suppliers pay a processing fee, it aligns with standard credit card fees and is outweighed by efficiency and cash flow gains.

Next Steps

At Intelloger, we specialize in helping businesses seamlessly integrate Oracle’s B2B virtual card solutions into their existing ERP systems. Our team of experts ensures a smooth transition, helping you optimize your accounts payable function to maximize cash flow, reduce administrative costs, and strengthen supplier relationships.

By partnering with Intelloger, you can leverage Oracle’s technology to modernize your AP processes and unlock real financial benefits.

For more information on technology insights and services, please contact Intelloger.

Recent Posts

- 6 Proven and Effective Steps to Improving the Financial Close Process with Oracle Solutions

- AI Agents in Oracle Fusion Apps: Driving Smarter Decisions, Faster Workflows, and Efficient Operations

- Navigating the Oracle Landscape: Emerging Trends Driving Innovation and Shaping 2025

- Supercharging Generative AI with RAG: Empowering AI with Memory, Knowledge, and Context

- Optimizing Accounts Payable: Boosting Working Capital and Efficiency with Oracle’s ERP Solution